GE HealthCare Technologies (GEHC)·Q4 2025 Earnings Summary

GE HealthCare Beats on Revenue and EPS, Guides Higher for 2026

February 4, 2026 · by Fintool AI Agent

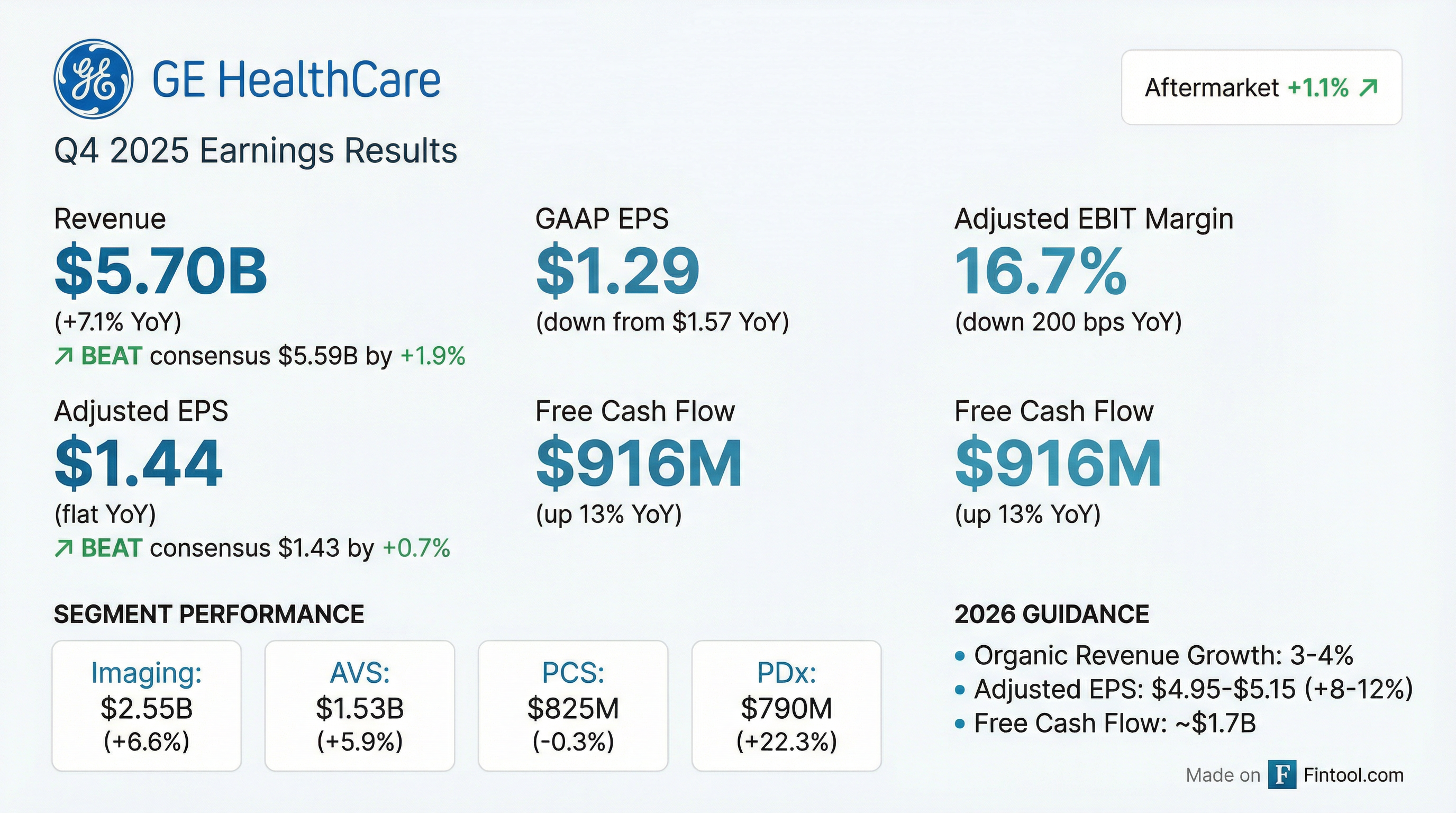

GE HealthCare (NASDAQ: GEHC) delivered a beat on both revenue and earnings in Q4 2025, extending its streak to nine consecutive quarters of EPS outperformance. Revenue of $5.70 billion exceeded consensus by 1.9%, while Adjusted EPS of $1.44 beat estimates of $1.43 by $0.01.

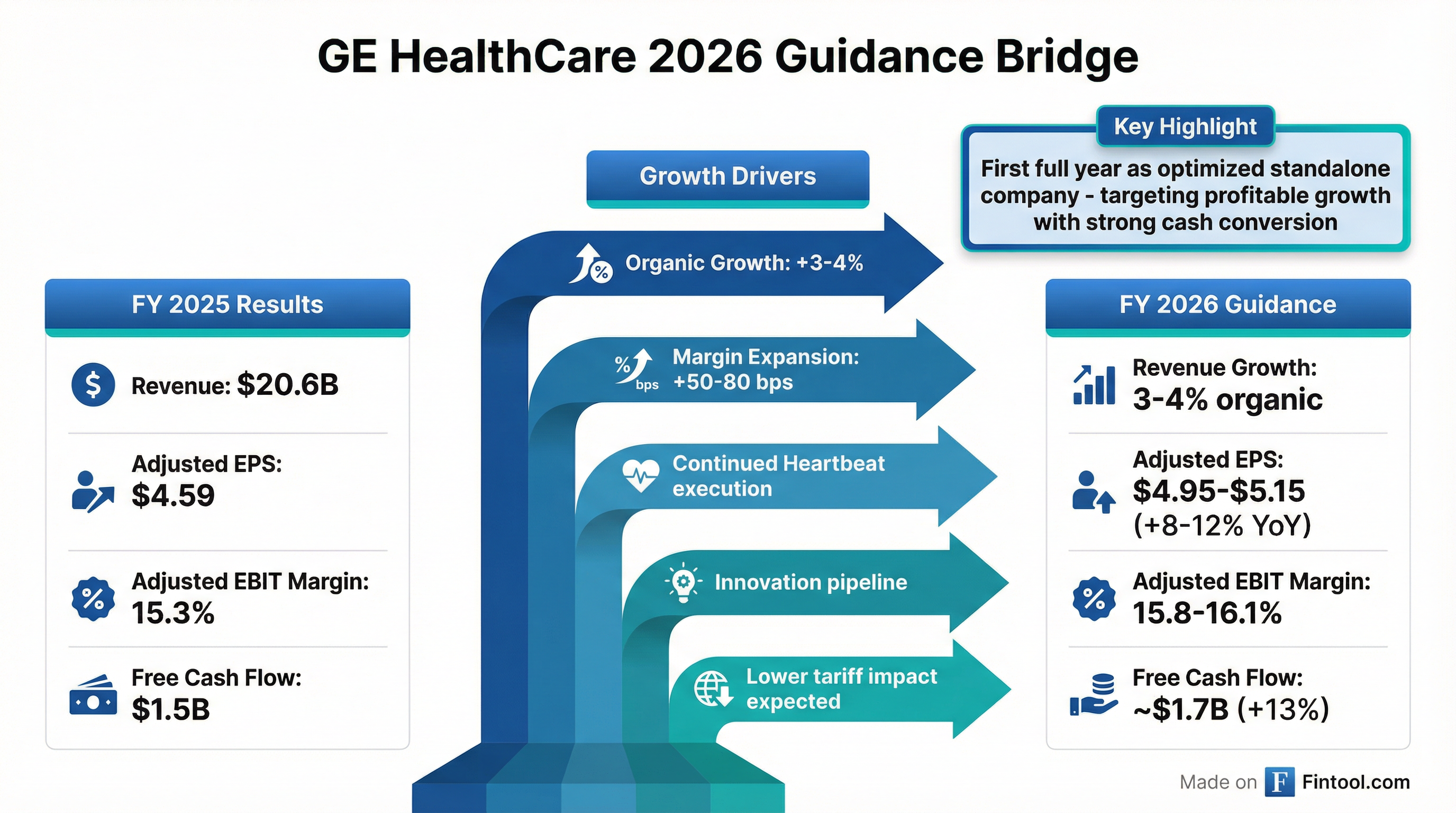

The company introduced 2026 guidance that implies 8-12% Adjusted EPS growth, with Adjusted EPS projected at $4.95-$5.15, margin expansion of 50-80 bps, and free cash flow of ~$1.7 billion. Shares rose approximately 1% in after-hours trading following the release.

Did GE HealthCare Beat Earnings?

Yes — both revenue and EPS exceeded expectations. The beat continues GE HealthCare's strong track record since spinning off from GE.

The revenue beat was driven by double-digit organic growth in Pharmaceutical Diagnostics (+12.7%) and mid-single-digit growth in Imaging and Advanced Visualization Solutions. The U.S. and EMEA markets remained particularly strong, with management noting an increase in the number of large customers planning capital equipment investments in 2026.

CFO Jay Saccaro highlighted the impact of tariffs: "Adjusted EPS was $1.44 per share, down 0.7%, including approximately $0.17 of tariff impact. Excluding this impact, adjusted EPS grew 11%."

Earnings Beat History (Last 9 Quarters):

What Changed From Last Quarter?

Several notable shifts emerged from Q3 to Q4 2025:

Improving Trends:

- Revenue acceleration: Q4 organic growth of 4.8% vs. 3.0% in Q3

- Free cash flow surged to $916M in Q4 vs. $593M in Q3

- Book-to-bill strengthened to 1.06x with record backlog

- Patient Care Solutions returned to near-flat after product hold resolution

Pressures:

- Adjusted EBIT margin of 16.7% down from 17.1% in Q3 due to tariff expenses and unfavorable mix

- GAAP EPS of $1.29 down from Q4 2024's $1.57 due to higher tax expense

Heartbeat Business System: Management highlighted the "Heartbeat" lean operating system deployed mid-2025. A key example: improving past due backlog through structured problem-solving, which drove an average monthly improvement of 25% vs. prior year, translating into improved sales and cash conversion.

CEO Peter Arduini: "Think of Heartbeat as the steady pulse that ultimately runs through our organization to deliver results."

How Did the Segments Perform?

Pharmaceutical Diagnostics was the standout performer, while Patient Care Solutions lagged:

Key segment insights:

- PDx benefited from growth in contrast media and radiopharmaceuticals, including early traction from Flyrcado. The Nihon Medi-Physics acquisition contributed to reported growth.

- Imaging saw strong demand for AI-enabled solutions and image-guided systems, particularly in CT and MR

- AVS maintained its position as the highest-margin segment at 24.7%, driven by software content and productivity gains

- PCS remained under pressure, though management noted sequential improvement following resolution of the product hold

What Did Management Guide?

GE HealthCare introduced 2026 full-year guidance that implies continued profitable growth:

Guidance context:

- 2026 Adjusted EPS midpoint of $5.05 is above the pre-earnings consensus of ~$4.94

- Management expects lower tariff impact in 2026 vs. 2025 based on current rates

- Margin expansion expected to be driven by Heartbeat operational system and productivity initiatives

- China guided down: Management is taking a "prudent approach" and anticipates a decline in China revenue for 2026

2026 EPS Bridge ($0.45 at midpoint):

- +$0.30 from volume growth

- +$0.30 from cost and productivity initiatives

- Offset by continued investments in SG&A and R&D to drive acceleration in sales performance

CFO Jay Saccaro stated: "We plan to continue our tariff mitigation actions in 2026, including supply chain shifts, product transfers to more tariff-efficient geographies, and expansion of duty-free USMCA efforts."

Capital Allocation Highlights

GE HealthCare demonstrated continued capital deployment flexibility:

Strategic transactions:

- Closed acquisitions of Nihon Medi-Physics and icometrix in 2025

- Announced planned $2.3 billion acquisition of Intelerad to advance cloud-enabled enterprise imaging; expected to close H1 2026

Balance sheet position (Dec 31, 2025):

- Cash and equivalents: $4.5 billion

- Total debt: $10.0 billion

- Revolving credit capacity: $3.5 billion

How Did the Stock React?

The stock was volatile on earnings day but ultimately moved higher in after-hours trading:

The initial intraday weakness gave way to aftermarket strength as investors digested the above-consensus 2026 guidance. The stock is trading at approximately 16x trailing adjusted EPS and 15.4x the FY 2026 midpoint guidance of $5.05.

Analyst sentiment: GE HealthCare holds a "Moderate Buy" rating with 12 Strong Buys, 1 Moderate Buy, and 7 Holds among 20 analysts. The mean price target is $91.45, implying ~14% upside from current levels.

Key Risks and Watchpoints

Several items bear monitoring heading into 2026:

-

Tariff uncertainty: While management expects lower tariff impacts in 2026, policy changes could pressure margins

-

Intelerad integration: The $2.3B acquisition represents the largest deal since the spin-off; execution risk on integration

-

Patient Care Solutions recovery: PCS organic growth remains negative; sustained recovery needed to hit overall growth targets

-

China decline expected in 2026: Management is explicitly guiding China down and taking a "prudent approach." While noting improved VBP tender win rates and a more robust imaging funnel, Q4 2025 was the most challenging quarter in China due to prior year comparisons.

-

Margin pressure: EBIT margins contracted 100 bps in FY 2025; guidance for only 50-80 bps expansion implies execution must improve

Flyrcado Update

CEO Peter Arduini provided a detailed update on the Flyrcado radiopharmaceutical launch:

"The feedback... is unanimous relative to the image quality, the specificity, the sensitivity that it brings, and then also ultimately the convenience that it will bring." — CEO Peter Arduini

Key developments:

- CMO partners now consistently operating at ~95% on-time delivery, allowing onboarding of more customers

- American Society of Nuclear Cardiology recommended PET as preferred imaging modality over SPECT (current standard of care)

- Weekly dose rate expected to continue increasing throughout 2026

Innovation Highlights

GE HealthCare's new product vitality rate reached 55% (revenue from products launched in past 3 years), up ~5% from prior year.

Major RSNA 2025 launches with regulatory timelines on track:

- Photonova Spectra — Photon-counting CT (manufacturing ready, awaiting approval)

- SIGNA MR with Freelium — Next-gen MRI technology

- Omni Total Body PET — CE marked, commercially available in Europe with installs in Australia

- StarGuide — Advanced SPECT system for alpha and beta imaging (CE marked)

- Allia — Interventional vascular system (FDA and CE approved)

- Vivid Pioneer — Most advanced cardiovascular ultrasound (contributing to strong AVS growth)

- SIGNA Sprint/Bolt — Under regulatory review

CEO Arduini noted: "There are nine products that probably are the nine biggest launches we've had in the last decade. All of those have 100 million-plus type capabilities in growth."

Additional milestones:

- Partnership with Indonesia Ministry of Health for 300+ CT scanners in urban and remote hospitals

- Seven-year agreement with University of Rochester Medical Center to advance theranostics and precision medicine

Q&A Highlights

On orders and backlog (Matthew Taylor, Jefferies): Management emphasized three metrics for business health: book-to-bill (1.06x Q4, 1.07x TTM), record backlog ($21.8B, up $2B YoY), and order growth (mid-single digits on trailing twelve-month basis). Orders acceleration expected in H2 2026 as new products receive regulatory approvals.

On capital equipment environment (Joanne Wuensch, Citi): "The capital backdrop in the US is solid... We just finished our latest survey, and many of those customers are anticipating investment increases versus what they previously assessed." The European market has also continued to improve with orders recovering in many geographies.

On Intelerad (Anthony Petroni, Mizuho):

- Expected to close H1 2026

- Advances cloud-enabled AI solutions in radiology and cardiology

- Extends capabilities across outpatient network

- Slightly dilutive but offset with cost efficiency to be neutral for remainder of 2026

- $270M revenue growing low double-digits, 30%+ EBITDA margin

On Omnipaque/Contrast Media (David Roman, Goldman Sachs): Despite rumors of new entrants, management has not seen competitive threats materialize. Supply remains tight industry-wide, and the business is highly correlated to procedures growth, which has been healthy.

Summary

GE HealthCare delivered a solid Q4 2025 with beats on revenue and EPS, extending its streak to nine consecutive quarters of earnings outperformance. The 2026 guidance calling for 8-12% Adjusted EPS growth, margin expansion, and stronger free cash flow exceeded Street expectations.

Key positives include record backlog, strong PDx momentum (+22% growth), and demonstrated tariff mitigation. Concerns center on PCS weakness, margin compression in 2025, and integration risk from the Intelerad acquisition.

The stock's ~1% aftermarket gain suggests investors are cautiously optimistic, though the muted reaction relative to the beat reflects the challenging margin environment and macro uncertainties.

View full Q4 2025 8-K filing | GEHC Company Profile | Prior Quarter: Q3 2025